Examine This Report about Stonewell Bookkeeping

Wiki Article

The Greatest Guide To Stonewell Bookkeeping

Table of ContentsMore About Stonewell BookkeepingThe 5-Second Trick For Stonewell BookkeepingGetting The Stonewell Bookkeeping To WorkThe Best Strategy To Use For Stonewell BookkeepingAn Unbiased View of Stonewell Bookkeeping

Below, we address the inquiry, just how does accounting aid a company? Truth state of a firm's finances and cash money circulation is constantly in change. In a feeling, bookkeeping publications represent a picture in time, yet only if they are updated typically. If a company is taking in bit, a proprietor should do something about it to increase earnings..webp)

It can likewise solve whether to raise its very own compensation from customers or customers. Nonetheless, none of these conclusions are made in a vacuum cleaner as factual numeric information need to buttress the financial choices of every small company. Such information is assembled via bookkeeping. Without an intimate understanding of the dynamics of your capital, every slow-paying client, and quick-invoicing creditor, becomes a celebration for stress and anxiety, and it can be a tedious and monotonous job.

You recognize the funds that are readily available and where they drop short. The news is not constantly excellent, yet at least you understand it.

Some Known Details About Stonewell Bookkeeping

The labyrinth of deductions, credit histories, exceptions, routines, and, naturally, penalties, suffices to simply surrender to the internal revenue service, without a body of efficient documentation to support your insurance claims. This is why a committed bookkeeper is vital to a tiny organization and deserves his/her weight in gold.

Your organization return makes cases and depictions and the audit intends at validating them (https://www.pubpub.org/user/stonewell-bookkeeping). Great accounting is all concerning connecting the dots between those representations and reality (White Label Bookkeeping). When auditors can adhere to the info on a ledger to receipts, financial institution declarations, and pay stubs, to name a few documents, they swiftly discover of the proficiency and stability of the service organization

4 Easy Facts About Stonewell Bookkeeping Described

Similarly, slipshod bookkeeping contributes to tension and anxiousness, it also blinds entrepreneur's to the potential they can recognize in the long run. Without the details to see where you are, you are hard-pressed to set a destination. Only with reasonable, detailed, and accurate data can a company owner or monitoring team story a training course for future success.Local business owner know ideal whether a bookkeeper, accounting professional, or both, is the best service. Both make important contributions to a company, though they are not the exact same career. Whereas a bookkeeper can gather and arrange the info needed to sustain tax obligation prep work, an accounting professional is better matched to prepare the return itself and truly assess the income statement.

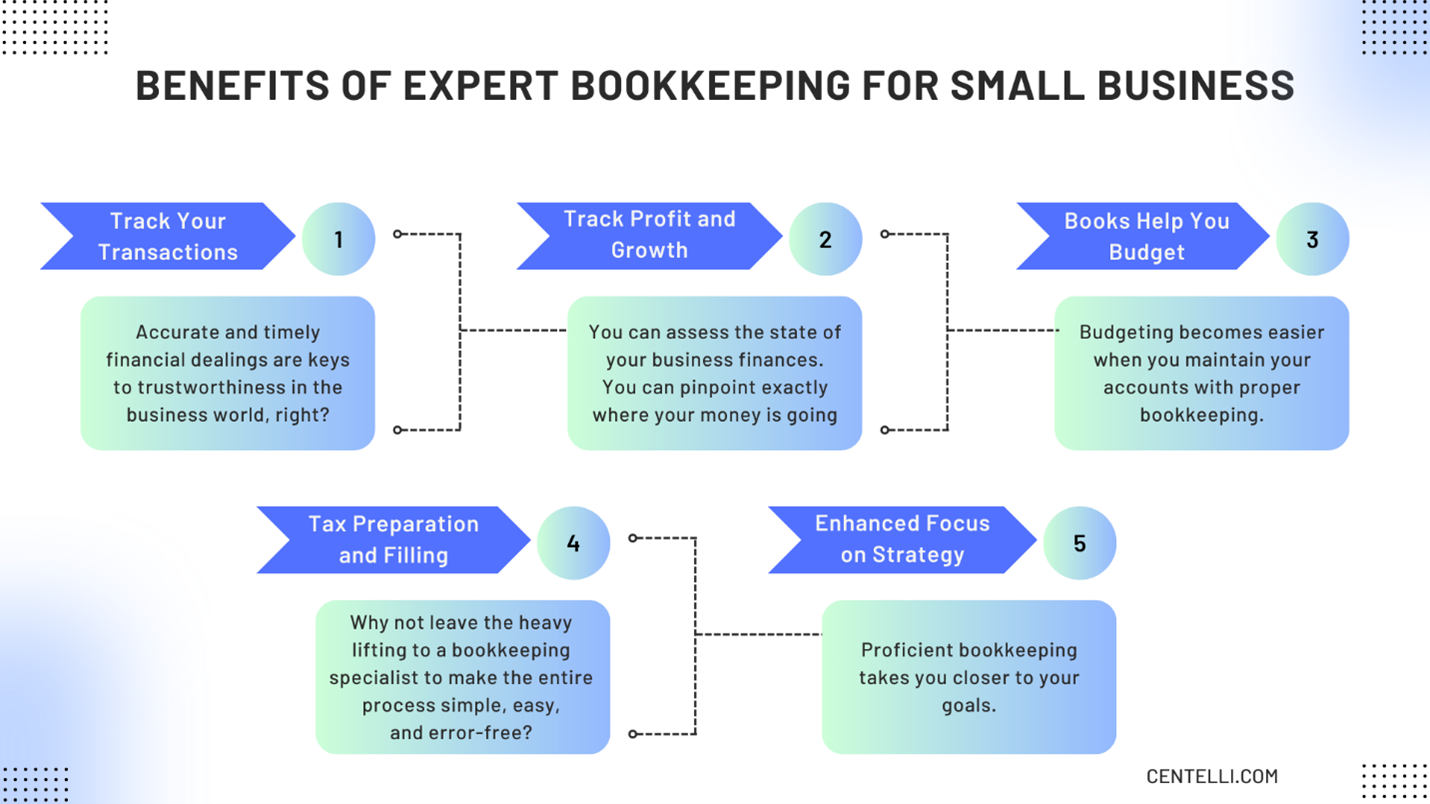

This short article will certainly explore the, consisting of the and just how it can profit your service. We'll also cover exactly how to get going with bookkeeping for a sound financial footing. Bookkeeping involves recording and organizing monetary transactions, including sales, acquisitions, payments, and invoices. It is the procedure of maintaining clear and succinct records so that all monetary details is quickly obtainable when required.

This short article will certainly explore the, consisting of the and just how it can profit your service. We'll also cover exactly how to get going with bookkeeping for a sound financial footing. Bookkeeping involves recording and organizing monetary transactions, including sales, acquisitions, payments, and invoices. It is the procedure of maintaining clear and succinct records so that all monetary details is quickly obtainable when required.By routinely upgrading monetary records, bookkeeping helps businesses. Having all the financial details easily accessible maintains the tax obligation authorities completely satisfied and stops any kind of final headache during tax filings. Regular accounting guarantees properly maintained and orderly records - https://moz.com/community/q/user/hirestonewell. This aids in quickly r and saves organizations from the stress of looking for documents during due dates (business tax filing services).

Some Known Factual Statements About Stonewell Bookkeeping

They are generally concerned regarding whether their money has been made use of correctly or not. They absolutely wish to know if the business is generating income or not. They likewise wish to know what capacity business has. These facets can be conveniently handled with accounting. The profit and loss declaration, which is ready frequently, reveals the revenues and also figures out the potential based upon the earnings.By keeping a close eye on monetary documents, companies can set practical goals and track their progress. Normal accounting guarantees that organizations stay compliant and avoid any type of fines or lawful issues.

Single-entry accounting is simple and works best for local business with couple of transactions. It involves. This technique can be contrasted to maintaining an easy checkbook. It does not track assets and responsibilities, making it much less extensive compared to double-entry bookkeeping. Double-entry accounting, on the other hand, is much more advanced and is normally thought about the.

Stonewell Bookkeeping Fundamentals Explained

This might be daily, weekly, or monthly, depending on your service's dimension and the quantity of purchases. Do not hesitate to look for help from Related Site an accounting professional or bookkeeper if you locate managing your economic records challenging. If you are seeking a totally free walkthrough with the Audit Option by KPI, call us today.Report this wiki page